Bitcoin Price Under Pressure as Large Holders Start Selling

John Barry | Tue Jul 02 2024

Multiple news stories about future Bitcoin sales were announced in June:

Mt. Gox Distribution – On June 24th it was reported that Mt. Gox will be returning 140,000 Bitcoins to investors who have been frozen out of their accounts since the Mt. Gox hack on February 28, 2014. At that time, Bitcoin was trading between $549 and $579. During the hack, over 850,000 Bitcoins were stolen. The partial return of funds still represents a significant financial return for these early investors. Payments are expected to start in July and continue through October.

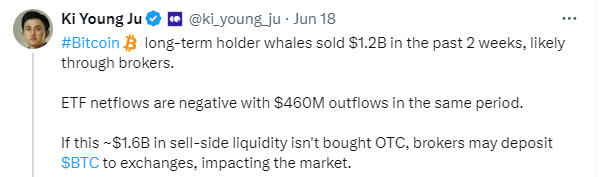

Crypto Whales Selling, ETF Flows are Negative Bitcoin

Ki Young Ju, from Crypto Quant, reported on long term Crypto Whale started selling $1.2 billion in early June and that ETF outflows had turned negative:

German Government Selling Seized Bitcoin

US Government Selling Bitcoin – On June 27th, the US Government moved $240 million of Bitcoin to Coinbase with the purpose of selling it. These are some of the funds obtained from the Silk Road seizure.

Price Chart Analysis:

The Bitcoin price chart shows a long-term bullish trend in place since mid-September and a short-term bearish reversal that started on June 7 when Bitcoin was trading at $72,000. This level has been a strong resistance line, tested five times since mid-March. Bitcoin Whale sales and German Government sales have been contributing factors to the June selloff. As the short term and long term trend converge, something has to give.

The Bitcoin price chart shows a long-term bullish trend in place since mid-September and a short-term bearish reversal that started on June 7 when Bitcoin was trading at $72,000. This level has been a strong resistance line, tested five times since mid-March. Bitcoin Whale sales and German Government sales have been contributing factors to the June selloff. As the short term and long term trend converge, something has to give.

Mt. Gox News adds to Selling Pressure

When the Mt. Gox news was released, Bitcoin immediately dropped from ~$63,000 to a low of $58,442. It has since recovered to $62,925, almost the same price as before the announcement on June 24th.

A key point to remember is that Germany has just started its selling program, with estimates indicating it still has over $2.5 billion worth of Bitcoin to sell. The Mt. Gox distribution will be around $9 billion. There is still a lot of Bitcoin planned to be sold in the next few months.

Returning to the price chart, the key support level to recognize is the $58,775 price level, which has been tested three times since March. Many believe that a price break below this level could lead to a Bitcoin price drop below the $40,000 level and possibly back to the $28,000 levels from September 2023.

A best practice is always to have funds available to buy the dips.

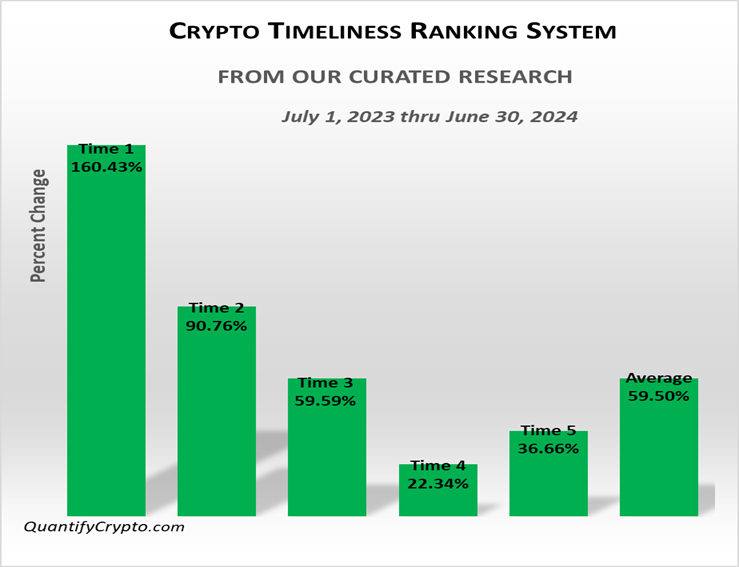

Maximizing Gains with Quantify Crypto’s In-Depth Research Reports

The timeliness rankings were exceptionally accurate for the full year, with “Very Bullish” achieving a 160% yearly return. Additionally our fundamental score ranking are also accurte with a yearly performance of over 120% for the "Highest" rated category.

To learn more, check out this link https://quantifycrypto.com/plans

Or send an e-mail to admin@quantifycrypto.net to learn about promotions and discounts.

Disclaimer

Quantify Crypto is an informational website that provides market data, technical analytics and links to news and commentary sources. Information published on Quantify Crypto platform should not be taken as investment advice in any way. Quantify Crypto is not an investment adviser and you agree to not site the Quantify Crypto platform or content as the reason or cause for making any trading decisions. Quantify Crypto is not accountable, directly, or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site. You agree not to consider the information on Quantify Crypto platform as a solicitation to invest in any cryptocurrencies, initial coin offerings, or other financial instruments.