Bitcoin Selling Update | FTX Distribution

John Barry | Tue Jul 09 2024

This is a continuation to last week’s article when Bitcoin was trading above $63,000. Most of the downturn in the past week has been due to the German Government selling Bitcoin and fear of the upcoming Mt. Got distribution. Bitcoin is now trading at $57,500 when this article was written.

German Government Bitcoin Selling Impacting Bitcoin Price

On June 6, the German government held a balance of $3.5 billion in Bitcoin, with Bitcoin trading at $71,834. They began selling their Bitcoin, which correlated with a decrease in Bitcoin's price. On July 8, the German government moved an additional $900 million to crypto exchanges, expectation is that most of this transfer will be sold during the upcoming week. As of July 8, they still have just over $1.3 billion in their internal wallet.

Notably, there was a $100 million increase in holdings on July 1, representing funds moved back from crypto exchanges to the government wallet. This appears to be unsold Bitcoin returning, indicating that the selling program targets specific price points rather than selling at market prices indiscriminately. It is possible that the selling program initiated on June 6 was due to the high price of Bitcoin.

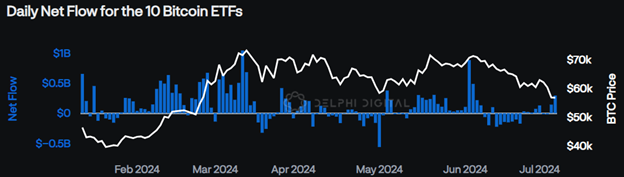

Bitcoin ETF Inflows Turn Positive on June 25th

In the past week, Bitcoin ETF inflows have turned slightly positive. From June 10th through June 27th, there was a total of $1.3 billion in negative Bitcoin outflows. This trend reversed from June 25th to July 8th, when there was a positive inflow of $670 million during these trading days. There was an inflow of $295 million on July 8 alone. It’s worth noting that much larger inflows and outflows occurred prior to June; for example, there was an inflow of $886 million on a single day on June 4th and an outflow of $564 million on May 1st.

Mt. Gox Distribution

As reported last week, Mt. Gox will be returning 140,000 Bitcoins to investors who have been frozen out of their accounts since the Mt. Gox hack on February 28, 2014. As of July 8, significant Mt. Gox transfers have not yet been sent to clients. Payments are expected to start shortly and continue through October.

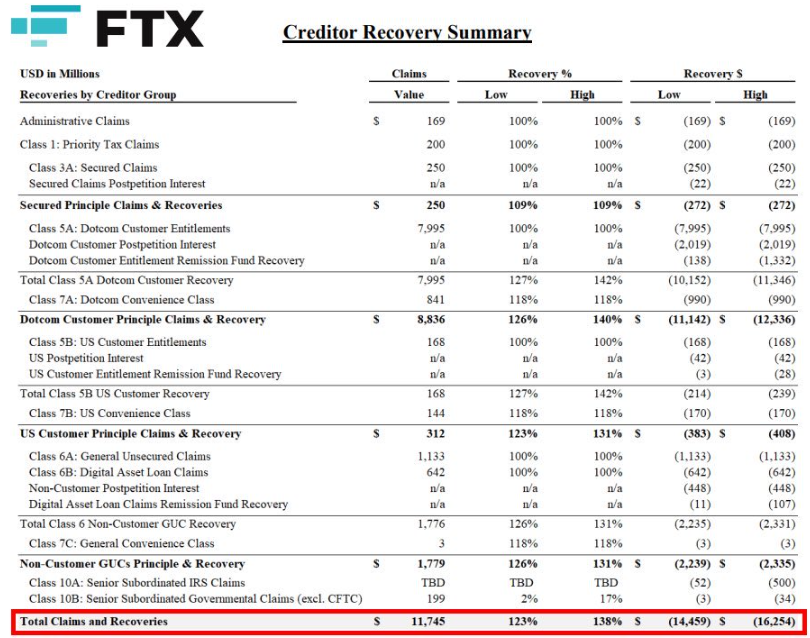

FTX Cash Payments to Clients

On July 9th, an FTX creditor recovery summary and spreadsheet were posted, detailing that between $14.459 billion to $16.254 billion will be returned as cash payments to customer bank accounts. These transfers are scheduled to occur during the fiscal 4th quarter of 2024.

Current Price Analysis

The downward trend in Bitcoin's price remains, with current analysis indicating support at the $52,500 level. Notably, Bitcoin has shown relative strength over the past five trading days, and there has been a clear instance of "buying the dip" by some Wall Street traders, evidenced by the increased inflow of ETF funds on July 8th.

The German government’s selloff on June 6th took the market by surprise. Since then, prominent Bitcoin supporters, like Justin Sun, have stated their willingness to purchase Bitcoin during this selloff. It is also expected that Michael Saylor’s MicroStrategy will be buyers to help support price levels. Significantly, the Mt. Gox selloff has not yet begun.

Crypto enthusiasts suggest that the FTX payments might offset the selling pressure from the Mt. Gox distribution. However, this seems overly optimistic. Many anticipate that the $9 billion Mt. Gox transfer will lead to additional selling, it’s difficult to argue against this point. Volatility is expected in the upcoming weeks and months, with potential buying opportunities on the horizon. The current price chart confirms a downward trend, and the pending Mt. Gox distribution will likely add further selling pressure.

A best practice is always to have funds available to buy the dips.

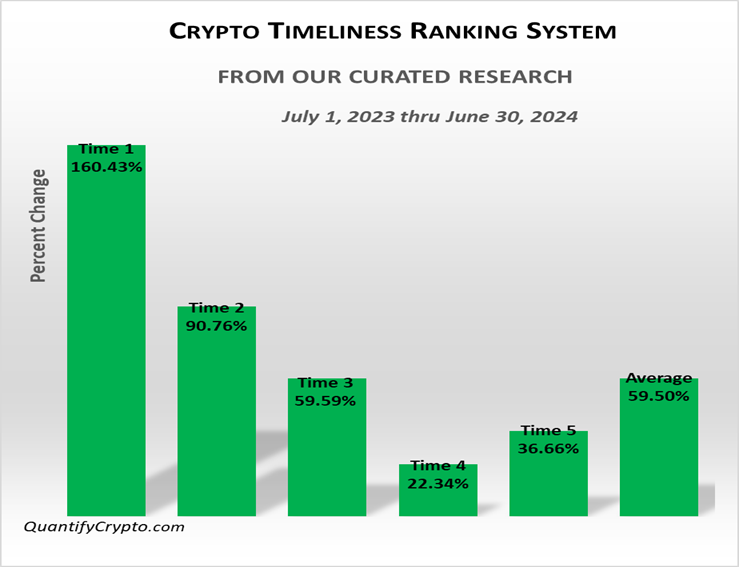

Maximizing Gains with Quantify Crypto’s In-Depth Research Reports

The timeliness rankings were exceptionally accurate for the full year, with “Very Bullish” achieving a 160% yearly return. Additionally our fundamental score ranking are also accurte with a yearly performance of over 120% for the "Highest" rated category.

To learn more, check out this link https://quantifycrypto.com/plans

Or send an e-mail to admin@quantifycrypto.net to learn about promotions and discounts.

Disclaimer

Quantify Crypto is an informational website that provides market data, technical analytics and links to news and commentary sources. Information published on Quantify Crypto platform should not be taken as investment advice in any way.

Quantify Crypto is not an investment adviser and you agree to not site the Quantify Crypto platform or content as the reason or cause for making any trading decisions. Quantify Crypto is not accountable, directly, or indirectly, for any damage or loss incurred, alleged or otherwise, in connection to the use or reliance of any content you read on the site.

You agree not to consider the information on Quantify Crypto platform as a solicitation to invest in any cryptocurrencies, initial coin offerings, or other financial instruments.